|

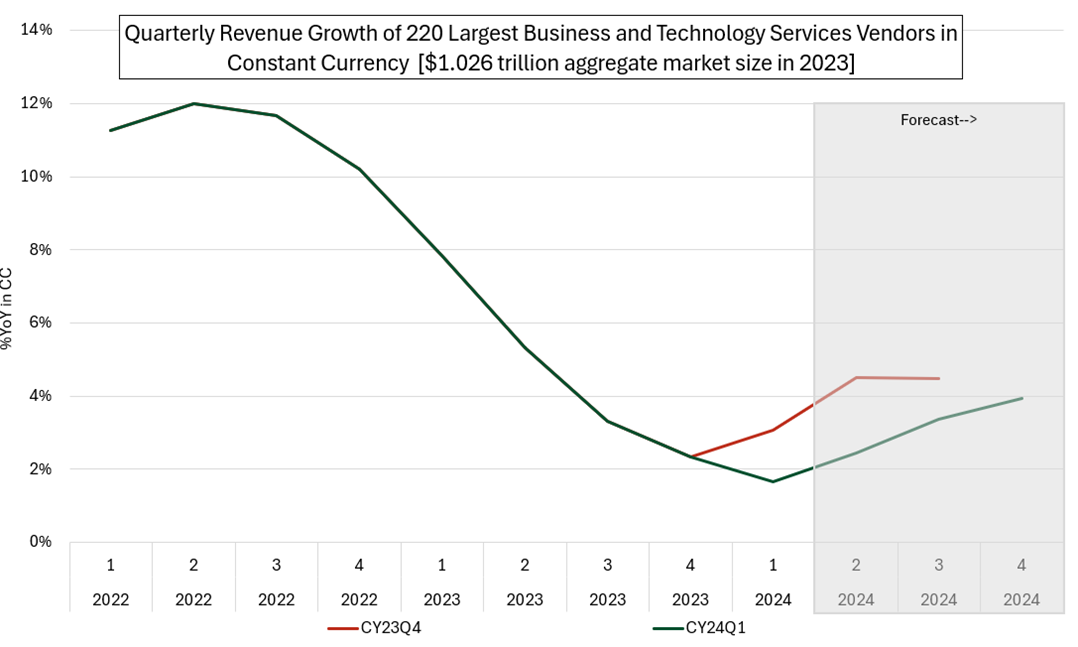

Let's dig into the takeaways from Q1 CY2024 Earnings Calls. Here are the 8 key themes I observed.

Schedule an intro session with me today to learn more about the Better Way Research project.

0 Comments

|

Chad HustonBetter Way Research Project ArchivesCategories |

RSS Feed

RSS Feed